Way of life behaviors resembling smoking, unhealthy weight-reduction plan, and bodily inactivity have been recognized because the main causes of continual ailments, together with coronary heart illness, stroke, diabetes, weight problems, metabolic syndrome, continual obstructive pulmonary illness, and a few sorts of most cancers. In 2016, US healthcare spending attributable to modifiable danger components was $730.4 billion, comparable to 27% of complete healthcare spending.

Accountability for healthcare prices is shared between employer and worker

For the reason that inflation caps legislated on wages on the time of World Struggle II, medical insurance advantages have been the primary worker perk within the US – virtually common and beneficiant in quantity. Whereas employers have largely remained dedicated to preserving well being protection as a good thing about employment, over time a part of the duty for the price of healthcare has shifted from employer to staff.

The first shift took the type of price sharing as 90% of staff with single protection have a normal annual deductible that should be met earlier than most companies are paid for by the plan.2 The typical deductible quantity in 2023 for staff with single protection and a normal annual deductible is $1,735. This has elevated 10% during the last 5 years and 53% during the last 10 years.

No matter their plan deductible, most coated staff additionally pay a portion of the associated fee for a doctor workplace go to. Many coated staff face a copayment (a set greenback quantity) after they go to a health care provider, however some staff have coinsurance necessities (a proportion of the coated quantity) as an alternative.

Over the past twenty years there was a noticeable and sustained improve in price sharing with staff choosing up an elevated share of healthcare prices at level of service.

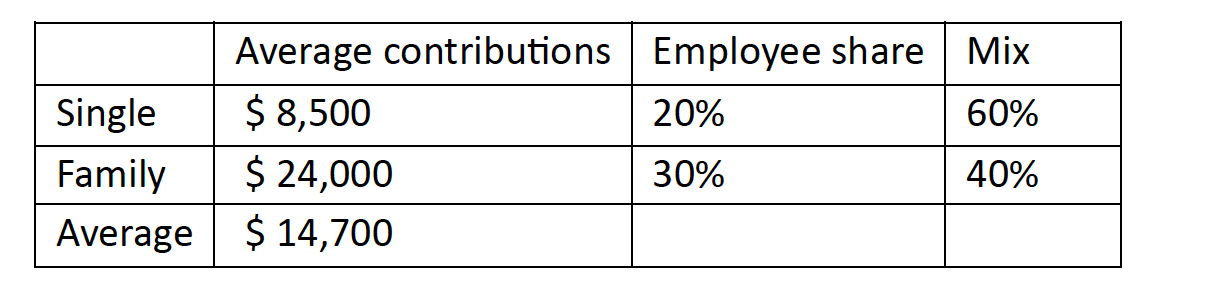

Most coated staff contribute to the price of the premium for his or her protection. On common, coated staff contribute 17% of the premium for single protection and 29% of the premium for household protection. The sharing of premium contributions between employer and staff has been largely steady during the last decade.

Well being insurers and employer funders of healthcare have usually felt comfy with the gradual price shift of medical bills to staff. Bills that fall inside a deductible, or bills related to an out of community go to or off-formulary treatment, are seen as largely controllable and considerably foreseeable, and due to this fact the employer has regarded the associated fee shift as a justifiable approach to comprise healthcare prices. Along with the employer benefiting from passing on a share of price to the worker, there’s a additional profit in that the worker is incentivized to scale back medical consumption and this has a positive impact on total premium charges.

The extent of price shifting although has probably reached a state of saturation as is evidenced by the leveling off of particular person borne prices in recent times in contrast with their giant development earlier than. It turns into more durable to justify the associated fee shift when the character of medical bills turn into much less controllable and fewer foreseeable.

A brand new horizon is opening, nonetheless, for employers to deal with excessive healthcare prices by making staff stronger companions of their well being contributions.

Inequity in the best way staff contribute to their medical insurance

Staff usually share in medical insurance premiums both by means of a proportion of the premium or a set greenback quantity. The quantities contributed differ between staff based mostly on solely a restricted variety of components. These would normally be kind of protection/plan advantages chosen and variety of dependents that the worker elects to be coated. These are within the worker’s direct management, and it due to this fact utterly justified to cost a better or decrease contribution share if the worker elects a better or decrease set of advantages or extra or fewer dependents.

Worker contributions don’t differ by age, gender or state of well being regardless that these have substantial danger price implications. Since they aren’t thought to be controllable, they aren’t used to calculate the worker share of contribution. (They do after all have robust bearing on the entire contribution charge).

Over the previous few years, supporting proof for a brand new danger issue has emerged that’s each controllable and has a robust causative impact on danger, specifically life-style habits. If two staff select totally different ranges of profit protection their worker premium shares shall be totally different as a result of they’re making decisions that affect their total medical insurance prices. But when two staff exhibit totally different life-style behaviors, they’re charged the identical worker share of premium regardless that they’re equally making decisions that affect their total medical insurance prices. That is clearly inequitable.

The case for differentiating worker contributions by life-style behaviors is especially robust, contemplating that the proof now reveals, at a granular stage, that small adjustments to some key behaviors resembling bodily exercise, have a causal affect on danger, and that is true throughout the chance spectrum. Moreover, advances in knowledge and expertise (wearables), now permit for individualized pathways and measurement.

Advantages of aligning worker contributions to their well being life-style behaviors

As a result of life-style behaviors are each a alternative the worker makes, in addition to a transparent determinant of complete medical insurance charges, it follows that the worker’s share of contribution ought to regulate both upwards or downwards based mostly on their life-style behaviors. The advantages of aligning the worker’s share of contribution with their life-style decisions are:

- Staff which might be exercising wholesome behaviors are inspired to proceed doing so, thereby persevering with to ease the strain on total healthcare prices from this group.

- Staff that aren’t exercising wholesome behaviors turn into incentivized to alter habits on account of their skill to lower their insurance coverage contributions (or keep away from contribution will increase). By adopting more healthy existence, they contribute in direction of making a more healthy danger pool for the employer.

- Staff that aren’t exercising wholesome behaviors and nonetheless select not to take action, bear a bigger share of the medical insurance contribution, thereby lowering the subsidy that the employer gives in direction of these staff.

The distinction in worker premium between these with higher life-style behaviors and people with worse life-style behaviors shouldn’t exceed the distinction in healthcare associated prices related to controllable life-style behaviors.

Circumstances wanted to implement habits aligned contributions

With a view to implement differential worker contributions based mostly on life-style behaviors, the next have to be in place:

- The life-style behaviors have to be measurable and verifiable. Staff have to be given clear visibility of what’s going to be measured and precisely how these measures shall be used to calculate

- Whereas self-reported behaviors should still permit the employer to implement life-style based mostly premiums, they’re removed from ultimate and danger undermining most of the advantages that the employer is predicted to realize from having a verified framework in place.

- The employer ought to present staff with instruments and training on how one can enhance life-style behaviors. Worker wellness applications and associated initiatives present a mechanism for doing so. These have to be given help and visibility from inside the firm. Ideally these applications ought to embrace incentives to encourage maximal participation. The actions and outcomes promoted by the employer’s wellness program ought to align with the factors utilized by the employer to distinguish worker contributions.

- With a view to adjust to the provisions of the Reasonably priced Care Act, the distinction in premium charged to essentially the most life-style compliant worker and the least life-style compliant worker should not exceed 30% of complete premium. It is a completely acceptable constraint as it’s in line with the precept said above that the distinction in premiums shouldn’t exceed the distinction in life-style associated danger prices, and these are lower than 30% of premium.

- All actions and biometric outcomes ought to have affordable different requirements in place for individuals for whom it will be unrealistic to realize these targets (e.g., on account of medical causes or incapacity). Cheap different requirements should supply a unique means by which such an worker can obtain the identical differential in insurance coverage contribution.

- With a view to maximize fairness, every worker must be offered a customized pathway to attaining enchancment in life-style behaviors and biometric markers. Exercise targets and how one can obtain them ought to think about demographic and danger components and information every worker in a means most resonant to that worker on how one can enhance life-style decisions and maintain wholesome behaviors.

- It goes with out saying that every one well being associated knowledge wants to stick at a minimal to HIPAA knowledge privateness requirements. Additional care must be taken to make sure that one is just not capable of infer well being associated information from the extent of premium carried by the worker.3

Financial results

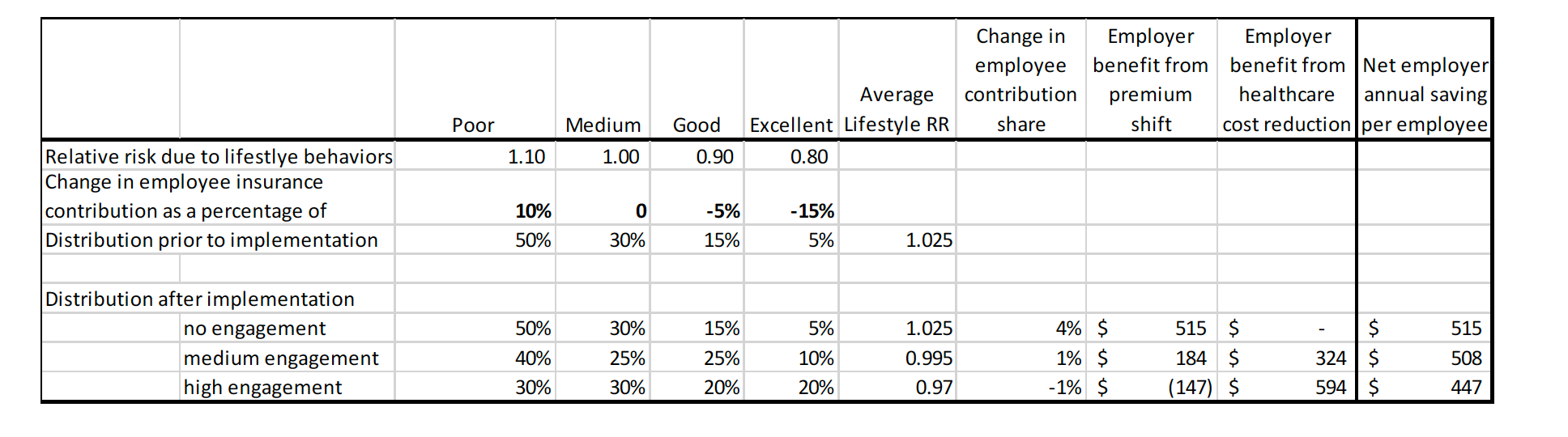

The financial results of differentiating worker insurance coverage contributions by life-style behaviors will depend upon how differentiated the employer chooses to make the premium (the utmost as famous is 30% differential) and the way the employer chooses to steadiness the upside and draw back to the worker. For illustrative functions we present right here a state of affairs the place the employer chooses the next differentials:

Common business contributions are used for calculation functions as follows:

The mannequin begins with an assumed distribution of staff throughout the 4 life-style habits classification ranges. Every classification stage carries a life-style relative danger ratio, calculated off a number of million life years of life-style and well being claims knowledge. Totally different engagement patterns are assumed. The employer’s web share of contribution adjustments relying on the combo of engagement. Moreover, total healthcare prices change based mostly on ranges of engagement and the employer’s share of enchancment in these is calculated.

The financial advantages to the employer are pretty steady regardless of ranges of engagement. Within the case of no-one altering their behaviors the profit is derived wholly from the “poor habits” staff carrying a better share of contribution. Within the extra fascinating and extra probably case of there being a shift in life-style behaviors, the profit to the employer emerges from enchancment in healthcare claims.

Aligned behaviors ends in extra equitable sharing

When worker medical insurance contributions are aligned with life-style behaviors, a extra equitablelan sharing of contributions is created. Staff turn into incentivized to have interaction in behaviors which have a causative discount in healthcare prices. The employer enjoys financial benefits below virtually all eventualities of engagement.

Alan Pollard is president of Vitality Group. Tanya Little is chief industrial officer of the corporate.