Assessing the Sustainability of CVS Well being Corp’s Dividend

CVS Well being Corp (NYSE:CVS) lately introduced a dividend of $0.67 per share, payable on 2024-05-01, with the ex-dividend date set for 2024-04-19. As traders sit up for this upcoming fee, the highlight additionally shines on the corporate’s dividend historical past, yield, and development charges. Utilizing the info from GuruFocus, let’s look into CVS Well being Corp’s dividend efficiency and assess its sustainability.

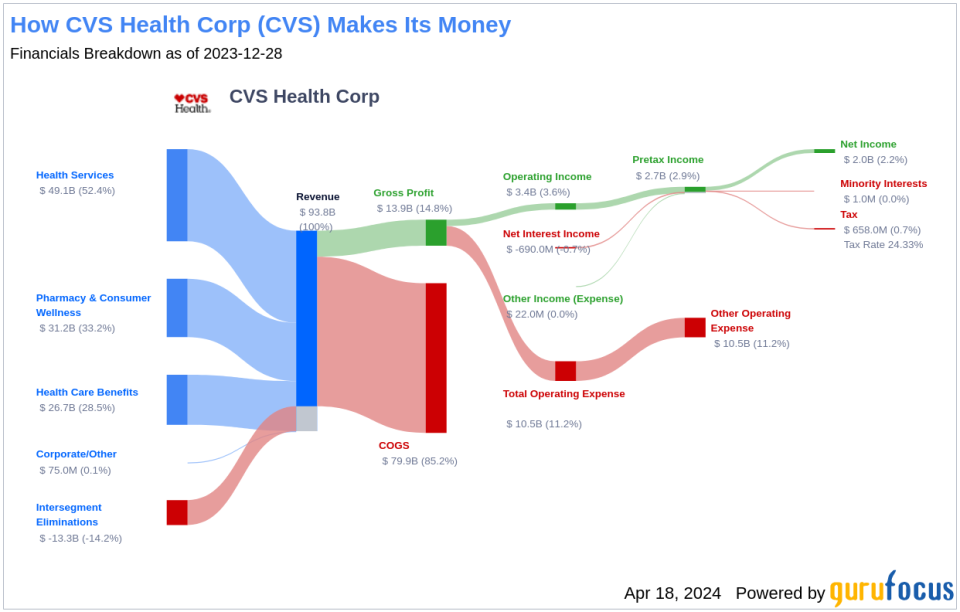

What Does CVS Well being Corp Do?

CVS Well being gives a various set of healthcare companies. Its roots are in its retail pharmacy operations, the place it operates over 9,000 shops primarily within the U.S. CVS can be the biggest pharmacy profit supervisor (acquired by way of Caremark), processing over 2 billion adjusted claims yearly. It additionally operates a top-tier well being insurer (acquired by way of Aetna) the place it serves about 26 million medical members. The corporate’s current acquisition of Oak Road provides main care companies to the combo, which might have vital synergies with all its present enterprise traces.

A Glimpse at CVS Well being Corp’s Dividend Historical past

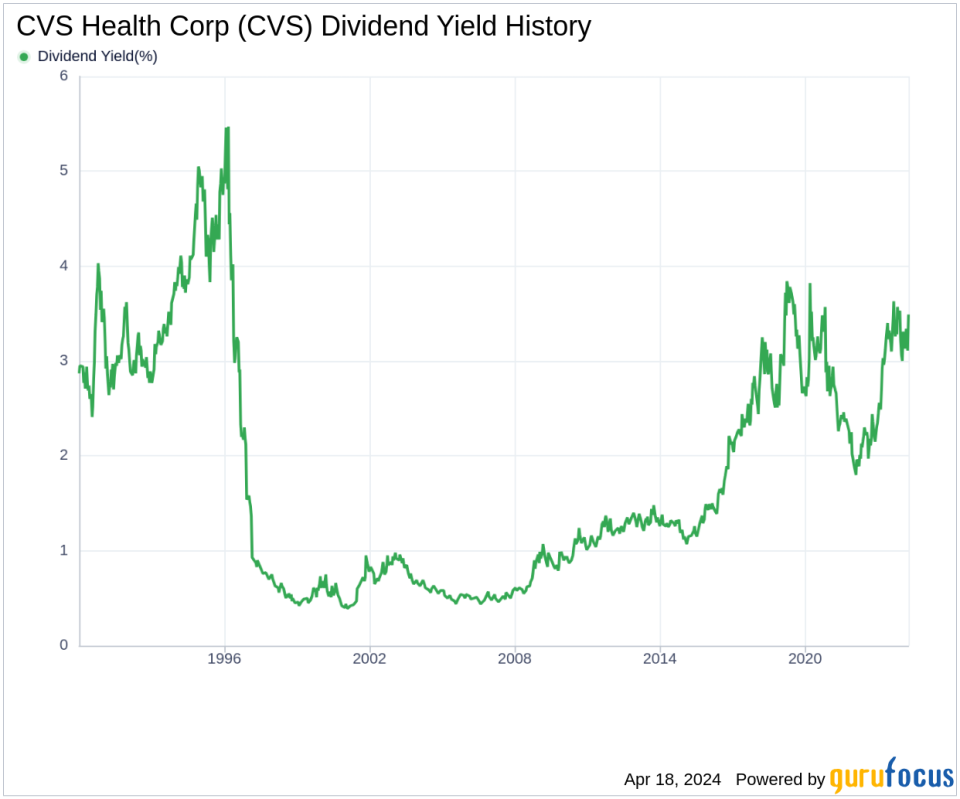

CVS Well being Corp has maintained a constant dividend fee document since 1986. Dividends are at the moment distributed on a quarterly foundation. CVS Well being Corp has elevated its dividend every year since 1997. The inventory is thus listed as a dividend aristocrat, an honor that’s given to corporations which have elevated their dividend every year for no less than the previous 27 years. Under is a chart displaying annual Dividends Per Share for monitoring historic traits.

Breaking Down CVS Well being Corp’s Dividend Yield and Development

As of at this time, CVS Well being Corp at the moment has a 12-month trailing dividend yield of three.61% and a 12-month ahead dividend yield of three.89%. This implies an expectation of elevated dividend funds over the subsequent 12 months.

Over the previous three years, CVS Well being Corp’s annual dividend development price was 6.60%. Prolonged to a five-year horizon, this price decreased to three.60% per 12 months. And over the previous decade, CVS Well being Corp’s annual dividends per share development price stands at 8.60%.

Primarily based on CVS Well being Corp’s dividend yield and five-year development price, the 5-year yield on value of CVS Well being Corp inventory as of at this time is roughly 4.31%.

The Sustainability Query: Payout Ratio and Profitability

To evaluate the sustainability of the dividend, one wants to guage the corporate’s payout ratio. The dividend payout ratio offers insights into the portion of earnings the corporate distributes as dividends. A decrease ratio means that the corporate retains a big a part of its earnings, thereby making certain the provision of funds for future development and sudden downturns. As of 2023-12-31, CVS Well being Corp’s dividend payout ratio is 0.32.

CVS Well being Corp’s profitability rank, gives an understanding of the corporate’s earnings prowess relative to its friends. GuruFocus ranks CVS Well being Corp’s profitability 7 out of 10 as of 2023-12-31, suggesting good profitability prospects. The corporate has reported internet revenue in 9 years out of the previous 10 years.

Development Metrics: The Future Outlook

To make sure the sustainability of dividends, an organization should have strong development metrics. CVS Well being Corp’s development rank of seven out of 10 means that the corporate’s development trajectory is nice relative to its rivals.

Income is the lifeblood of any firm, and CVS Well being Corp’s income per share, mixed with the 3-year income development price, signifies a powerful income mannequin. CVS Well being Corp’s income has elevated by roughly 10.70% per 12 months on common, a price that underperforms roughly 63.16% of worldwide rivals.

The corporate’s 3-year EPS development price showcases its functionality to develop its earnings, a vital element for sustaining dividends in the long term. In the course of the previous three years, CVS Well being Corp’s earnings elevated by roughly 3.50% per 12 months on common, a price that underperforms roughly 57.89% of worldwide rivals.

Lastly, the corporate’s 5-year EBITDA development price of 13.80%, which underperforms roughly 33.33% of worldwide rivals.

Conclusion: Evaluating CVS Well being Corp’s Dividend Prospects

Buyers contemplating CVS Well being Corp for its dividend ought to be inspired by the corporate’s historical past of constant dividend funds and its standing as a dividend aristocrat. With a stable payout ratio and a commendable profitability rank, CVS Well being Corp seems to be in a superb place to keep up its dividend funds. Whereas some development metrics point out room for enchancment, the general image suggests an organization with a sustainable dividend outlook. As worth traders, one would possibly ponder if CVS Well being Corp’s present yield and development prospects align with their funding technique. May CVS Well being Corp be the proper addition to a dividend-focused portfolio?

GuruFocus Premium customers can display for high-dividend yield shares utilizing the Excessive Dividend Yield Screener.

This text, generated by GuruFocus, is designed to supply basic insights and isn’t tailor-made monetary recommendation. Our commentary is rooted in historic information and analyst projections, using an neutral methodology, and isn’t supposed to function particular funding steering. It doesn’t formulate a suggestion to buy or divest any inventory and doesn’t contemplate particular person funding aims or monetary circumstances. Our goal is to ship long-term, basic data-driven evaluation. Remember that our evaluation may not incorporate the newest, price-sensitive firm bulletins or qualitative info. GuruFocus holds no place within the shares talked about herein.

This text first appeared on GuruFocus.