If we wish to discover a inventory that would multiply over the long run, what are the underlying tendencies we should always search for? One widespread strategy is to attempt to discover a firm with returns on capital employed (ROCE) which can be growing, along side a rising quantity of capital employed. In the end, this demonstrates that it is a enterprise that’s reinvesting income at growing charges of return. Nonetheless, after briefly wanting over the numbers, we do not assume Astrana Well being (NASDAQ:ASTH) has the makings of a multi-bagger going ahead, however let’s take a look at why that could be.

What Is Return On Capital Employed (ROCE)?

If you have not labored with ROCE earlier than, it measures the ‘return’ (pre-tax revenue) an organization generates from capital employed in its enterprise. To calculate this metric for Astrana Well being, that is the system:

Return on Capital Employed = Earnings Earlier than Curiosity and Tax (EBIT) ÷ (Whole Property – Present Liabilities)

0.12 = US$85m ÷ (US$933m – US$219m) (Primarily based on the trailing twelve months to December 2023).

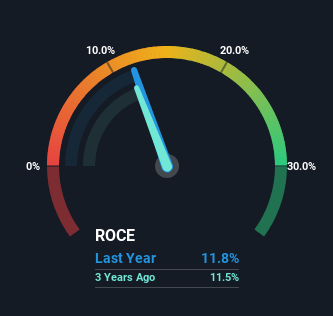

Thus, Astrana Well being has an ROCE of 12%. That is a comparatively regular return on capital, and it is across the 11% generated by the Healthcare business.

Take a look at our newest evaluation for Astrana Well being

Above you may see how the present ROCE for Astrana Well being compares to its prior returns on capital, however there’s solely a lot you may inform from the previous. If you would like to see what analysts are forecasting going ahead, you need to take a look at our free analyst report for Astrana Well being .

What The Pattern Of ROCE Can Inform Us

Once we seemed on the ROCE development at Astrana Well being, we did not achieve a lot confidence. To be extra particular, ROCE has fallen from 21% over the past 5 years. Though, given each income and the quantity of belongings employed within the enterprise have elevated, it might recommend the corporate is investing in development, and the additional capital has led to a short-term discount in ROCE. If these investments show profitable, this may bode very properly for long run inventory efficiency.

Our Take On Astrana Well being’s ROCE

Whereas returns have fallen for Astrana Well being in current occasions, we’re inspired to see that gross sales are rising and that the enterprise is reinvesting in its operations. And the inventory has adopted go well with returning a significant 90% to shareholders over the past 5 years. So whereas buyers appear to be recognizing these promising tendencies, we might look additional into this inventory to verify the opposite metrics justify the constructive view.

Yet another factor, we have noticed 1 warning signal dealing with Astrana Well being that you just would possibly discover attention-grabbing.

For individuals who prefer to put money into stable corporations, take a look at this free checklist of corporations with stable stability sheets and excessive returns on fairness.

Have suggestions on this text? Involved in regards to the content material? Get in contact with us immediately. Alternatively, e mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is normal in nature. We offer commentary primarily based on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles aren’t meant to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your targets, or your monetary state of affairs. We purpose to deliver you long-term centered evaluation pushed by basic knowledge. Notice that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.