Key Insights

-

Considerably excessive institutional possession implies Ramsay Well being Care’s inventory worth is delicate to their buying and selling actions

-

51% of the enterprise is held by the highest 7 shareholders

-

Possession analysis together with analyst forecasts information assist present a superb understanding of alternatives in a inventory

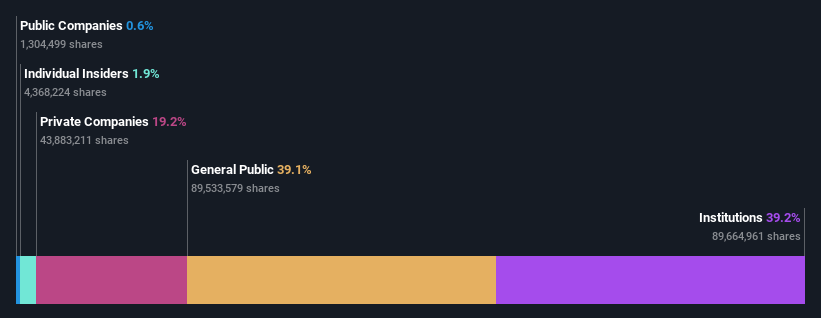

If you wish to know who actually controls Ramsay Well being Care Restricted (ASX:RHC), then you definitely’ll have to take a look at the make-up of its share registry. We will see that establishments personal the lion’s share within the firm with 39% possession. In different phrases, the group stands to realize essentially the most (or lose essentially the most) from their funding into the corporate.

Consequently, institutional buyers endured the very best losses final week after market cap fell by AU$437m. Evidently, the latest loss which additional provides to the one-year loss to shareholders of 23% may not go down nicely particularly with this class of shareholders. Establishments or “liquidity suppliers” management massive sums of cash and subsequently, all these buyers often have lots of affect over inventory worth actions. Consequently, if the decline continues, institutional buyers could also be pressured to promote Ramsay Well being Care which could harm particular person buyers.

Let’s take a better look to see what the several types of shareholders can inform us about Ramsay Well being Care.

See our newest evaluation for Ramsay Well being Care

What Does The Institutional Possession Inform Us About Ramsay Well being Care?

Institutional buyers generally examine their very own returns to the returns of a generally adopted index. So they typically do think about shopping for bigger firms which are included within the related benchmark index.

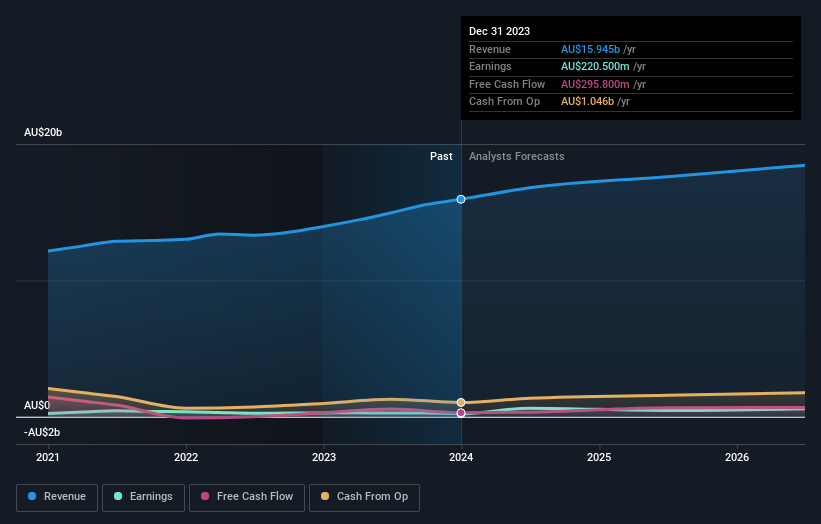

As you’ll be able to see, institutional buyers have a good quantity of stake in Ramsay Well being Care. This means some credibility amongst skilled buyers. However we won’t depend on that truth alone since establishments make unhealthy investments generally, similar to everybody does. When a number of establishments personal a inventory, there’s all the time a danger that they’re in a ‘crowded commerce’. When such a commerce goes flawed, a number of events might compete to promote inventory quick. This danger is greater in an organization with no historical past of progress. You’ll be able to see Ramsay Well being Care’s historic earnings and income beneath, however remember there’s all the time extra to the story.

We observe that hedge funds do not have a significant funding in Ramsay Well being Care. Our information exhibits that Paul Ramsay Holdings Pty. Restricted is the biggest shareholder with 19% of shares excellent. With 10% and 6.4% of the shares excellent respectively, Netwealth Investments Ltd. and State Road International Advisors, Inc. are the second and third largest shareholders.

We did some extra digging and located that 7 of the highest shareholders account for roughly 51% of the register, implying that together with bigger shareholders, there are a number of smaller shareholders, thereby balancing out every others pursuits considerably.

Whereas it is smart to review institutional possession information for a corporation, it additionally is smart to review analyst sentiments to know which approach the wind is blowing. Fairly a number of analysts cowl the inventory, so you would look into forecast progress fairly simply.

Insider Possession Of Ramsay Well being Care

The definition of firm insiders will be subjective and does differ between jurisdictions. Our information displays particular person insiders, capturing board members on the very least. Administration in the end solutions to the board. Nevertheless, it’s not unusual for managers to be government board members, particularly if they’re a founder or the CEO.

I typically think about insider possession to be a superb factor. Nevertheless, on some events it makes it harder for different shareholders to carry the board accountable for choices.

We will see that insiders personal shares in Ramsay Well being Care Restricted. The insiders have a significant stake price AU$219m. Most would see this as an actual constructive. It’s good to see this stage of funding by insiders. You’ll be able to verify right here to see if these insiders have been shopping for lately.

Normal Public Possession

Most of the people– together with retail buyers — personal 39% stake within the firm, and therefore cannot simply be ignored. Whereas this group cannot essentially name the pictures, it may actually have an actual affect on how the corporate is run.

Personal Firm Possession

Plainly Personal Corporations personal 19%, of the Ramsay Well being Care inventory. It is likely to be price trying deeper into this. If associated events, equivalent to insiders, have an curiosity in one in every of these personal firms, that needs to be disclosed within the annual report. Personal firms may have a strategic curiosity within the firm.

Subsequent Steps:

Whereas it’s nicely price contemplating the totally different teams that personal an organization, there are different elements which are much more necessary. Bear in mind that Ramsay Well being Care is exhibiting 2 warning indicators in our funding evaluation , and 1 of these should not be ignored…

Finally the long run is most necessary. You’ll be able to entry this free report on analyst forecasts for the corporate.

NB: Figures on this article are calculated utilizing information from the final twelve months, which confer with the 12-month interval ending on the final date of the month the monetary assertion is dated. This will not be in keeping with full yr annual report figures.

Have suggestions on this text? Involved in regards to the content material? Get in contact with us instantly. Alternatively, electronic mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is normal in nature. We offer commentary primarily based on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles aren’t supposed to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your targets, or your monetary scenario. We purpose to deliver you long-term targeted evaluation pushed by basic information. Word that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.